BRAZIL LITHIUM

BRAZIL LITHIUM

Soon after its formation, Pacha began surveying Brazil and Europe for Lithium bearing pegmatite opportunities. Prevailing legislation in Brazil had created limited market access constrained foreign investment and exploration. However, under the Bolsanaro administration the mining investment environment for Lithium has improved significantly.

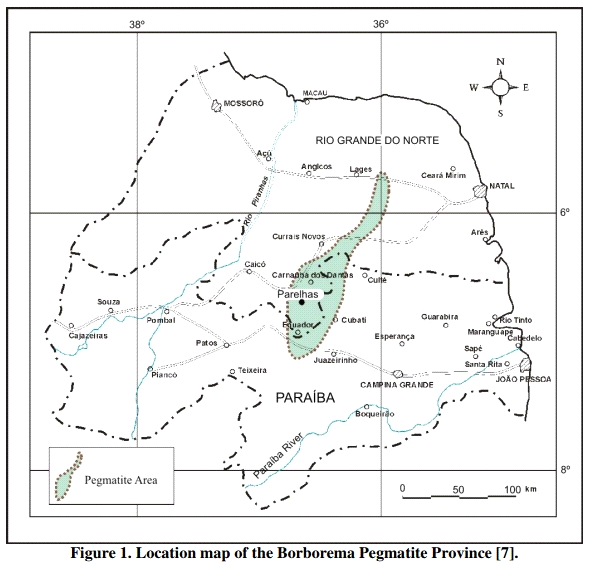

Brazil has one of the largest pegmatite occurrences in the world, yet Lithium from pegmatite-hosted bodies has been mined mainly as an accessory mineral and to date, there has been very little modern and systematic exploration for the metal. There are two major provinces of Lithium bearing pegmatites in Brazil, being the Eastern region (centered on Minas Gerais State) and the Borborema region (straddling several states in the NE of Brazil).

Lithium in pegmatites is generally associated with tantalite-columbite, tin and gemstones. Many of the pegmatites in Brasil hosting Lithium are actually being mined for tourmaline, safire aquamarine, etc. Lithium minerals were bought by the Brazilian government for use in its nuclear energy program, but when this was closed down about 20 years ago most of the mines were abandoned.

In Minas Gerais state, near Aracuai, several pegmatites have been exploited on a sporadic basis. These pegmatites, have been traditionally mined for cassiterite, tantalite and beryl, with Lithium minerals having also been recovered. As a result of an increase in demand for Lithium, exploration resulted in the discovery of important petalite pegmatites, reported to contain 100,000 tons of petalite grading 2% Li. Spodumene reserves have been estimated at 300,000 tons.

Historically the most important producer of Lithium minerals has been Arqueana do Minerios e Metais. The company mines spodumene, petalite, lepidolite, ambligonite beryl and cassiterite from the pegmatite bodies at Cachoeira mine near Aracuai and Itinga. It produces roughly 11,200 tons per year of ores with an average content of 5.38% Li2O and supplies spodumene concentrates to the Companhia Brasileira do Litio.

Recently a new player Sigma Lithium (TSXV: SGMA; US-OTC: SGMLF) has arrived on the scene. Late last year Sigma began extracting Lithium from its Grota de Cirilo mine, also near Aracuai, on a pilot plant basis. In April 2019 the company signed a US$30M offtake agreement with Japan’s trading giant, Mitsui, for delivery of 55,000 tonnes of battery grade concentrate annually for a six term.

The Lithium concentration plant will have an initial processing capacity of 1,500,000 tonnes of spodumene ore per year. That plant design currently contemplates an output of 220,000 tonnes of battery-grade spodumene concentrate annually.

In the Borborema region Pacha has identified what is believed to be one the most important strategic blocks containing Lithium bearing pegmatites. Pacha has assembled some 3000 ha. of exploration concessions. We have also begun negotiating an agreement with two major neighbouring concession holders to secure a contiguous block in which Pacha, with its Brazilian partners, would control the majority of the Lithium bearing pegmatites in the target zone for exploitation.

World Supply

Lithium is not, in fact, a rare commodity with identified resources approximating 35 million tons worldwide. In the United States, identified sources total 5.5 million tons while in Bolivia and Chile stocks are 9 million tons and in excess of 7.5 million tons, respectively. Identified lithium resources for Argentina, China, and Australia are 6.5 million tons, 5.4 million tons, and 1.7 million tons, respectively. Canada, DRC, Russia, have resources of approximately 1 million tons each while Identified lithium resources for Brazil total 180,000 tons.

In 2016, Australian companies delivered 14,300 tons of metal, an increase of 200 tons from the year prior. The country develops the Greenbushes lithium project, which is owned and operated by Talison Lithium. Greenbushes is the world’s largest known single lithium reserve and has been operational for over 25 years. The location also provides easy access for Asian electronics companies, which are the top lithium consumers worldwide.

Chilean miners delivered 12,000 tons of lithium in 2016, up from 10,000 tons last year, providing the second-highest amount of lithium and is poised to take back the Chilean position as number-one producer in the future. This production is largely controlled by just two companies Sociedad Quimica y Minera de Chile (SQM) and US-based Albemarle, who together account for roughly 46% of world market share.

Overall, Chile possesses the largest confirmed lithium reserves in the world, with over 7.5 million tons of the element. By that estimate, the country hosts roughly five times more lithium than Australia, which features the second-largest reserves. In particular, the Atacama salt flat is the most significant source of country’s massive lithium production, and it has been reported that one project alone encompasses approximately 20% of the world’s total lithium.

Lithium – Chile’s buried treasure

While Australia extracts lithium from traditional hard-rock mines, Chile’s lithium is found in brines below the surface of salt flats. These brines are collected and treated in order to separate the element from wastewater.

The third largest producer in 2016 was Argentina which delivered 5000 surpassing for the first time China which mined 2,000 tons. A relative newcomer to the industry, Argentina has enjoyed record foreign investment in its mining sector as the Macri government implemented robust pro-business policies creating a mini-boom in Lithium evaporites exploitation.

China’s massive electronics industry makes the country also the world’s largest consumer of the commodity. Currently, the majority of Chinese lithium output comes from the Chang Tang plain in Western Tibet. The US Geological Survey indicates that the country’s reserves is 3.5 million tons.

In Europe meanwhile lithium pegmatite occurrences are found in Finland, Portugal, Spain, Serbia Germany and mostly notably Czech Republic which is considered to be the largest resource of the metal in Europe.

Geology & Mineralization

Lithium bearing Pegmatite is difficult to sample representatively due to the large size of the constituent mineral crystals. Often, bulk samples of some 50–60 kg of rock must be crushed to obtain a meaningful and repeatable result. Hence, pegmatite is often characterised by sampling the individual minerals which comprise the pegmatite, and comparisons are made according to mineral chemistry.

Geochemically, pegmatites typically have major element compositions approximating “granite”, however, when found in association with granitic plutons it is likely that a pegmatite dike will have a different trace element composition with greater enrichment in large-ion lithophile (incompatible) elements, boron, beryllium, aluminium, potassium and lithium, uranium, thorium, cesium, et cetera.

Pegmatitic Granite

Occasionally, enrichment in the unusual trace elements will result in crystallisation of equally unusual and rare minerals such as beryl, tourmaline, columbite, tantalite, zinnwaldite and so forth. In most cases, there is no particular genetic significance to the presence of rare mineralogy within a pegmatite, however it is possible to see some causative and genetic links between, say, tourmaline-bearing granite dikes and tourmaline-bearing pegmatites within the area of influence of a composite granite intrusion (Mount Isa Inlier, Queensland, Australia).

The mineralogy of a pegmatite is in most cases dominated by some form of feldspar, often with mica and usually with quartz, being altogether “granitic” in character. Beyond that, pegmatite may include most minerals associated with granite and granite-associated hydrothermal systems, granite-associated mineralisation styles, for example greisens, and somewhat with skarn-associated mineralisation.

Lithium metal is soft enough to be cut with a knife. When cut, it possesses a silvery-white color that quickly changes to gray as it oxidizes to lithium oxide. It is also highly reactive and flammable element. While it has one of the lowest melting points among all metals (180°C), it has the highest melting and boiling points of the alkali metals. It is most frequently found in deposits such as spodumene and pegmatite minerals, with larger resources in the U.S., Canada, Australia, China, Zimbabwe, and Russia. Lithium possesses a unique chemical profile making it the lightest metal in the periodic table and the least dense solid element. Its atomic number is 3 (right behind helium at 2 and hydrogen at 1), and its density is just 0.53 kg/L.

Lithium ingots with a thin layer of black nitride tarnish

Exploration

Some 61% of known global lithium reserves and resources is found in high altitude continental brine aquifers of Argentina, Bolivia, Chile, and China and Tibet. About 34% occur in lithium mineral deposits mainly in Australia, Canada, USA, and Zimbabwe of which three quarters are crystalline hard rock deposits and a quarter are soft rock deposits. The 5% balance of this tonnage is contained in oilfield and geothermal brines in the western USA.

The global production of lithium is forecast to reach 600,000 tons by 2020. Mining lithium metal is not expensive, especially at high mountain plateaus, where lithium is collected from brine ponds evaporated by the sun. Brine excavation is the predominant lithium extraction technology widely used today, as actual mining of lithium ores is much more expensive. It contributes to 50% of the world lithium production mainly in the form of lithium carbonate and is also a major source of potash recovered at an earlier stage in the brine concentration process.

Typically lithium bearing minerals are mined exclusively from pegmatite hard rocks. Worldwide, numerous deposits, primarily containing spodumene and petalite, are being intensively explored with projects at various stages in Canada, Finland, Czech Republic and Australia. Beneficiated lithium minerals are used in the mineral form and, today almost exclusively in China, for chemical conversion to lithium carbonate. Spodumene (8.0% Li2O), is the most common commercially exploited lithium mineral. Almost 50% of the spodumene mined in Australia today is converted to lithium carbonate for export China.

Less commercialized are zinnwaldite (3.4 Li2O), petalite (4.9% Li2O), lepidolite (4.1% Li2O), and amblygonite (10.0% Li2O). Advanced exploration is proving historically well-known and large resources of hectorite (1.2% Li2O) in northwest Nevada, USA. Recently, the new lithium-boron mineral jadarite (7.3% Li2O) was discovered in sedimentary soft rock in Serbia where exploration of a massive resource is ongoing by mining major, Rio Tinto.

Why Lithium?

It’s no secret that the sector continues to enjoy rapid growth, driven largely by demand for the metal’s use is in lithium-ion batteries as an energy source for electric vehicles.

Propelled by Tesla Motors and other car companies, electric vehicles are becoming increasingly common, and demand for lithium is increasing in tandem. Last year the number electric vehicles (EVs) on the road globally surpassed the one million mark and an increasing number of jurisdictions around the world focusing seriously on the growth of EV sales, we can expect strong growth in lithium-ion battery demand.

Now that lithium-ion batteries are the predominant choice for electric vehicles because they have a higher energy density than other technologies, questions arise about the global supply of lithium.

The latest data from the US Geological Survey (USGS) shows that the world’s top lithium-producing countries are doing their best to meet that growing demand. Worldwide lithium production rose 12 percent from 2015 to 2016, coming in at 35,000 metric tons (MT) last year.

Some industry experts forecast demand, however, will be as high as 125% of supply by 2020 driven by electric vehicles and grid storage. Notwithstanding the advancement of alternative technology that may disrupt the Lithium/cobalt manganese matrix, (i.e. vanadium-based battery systems) the short and medium outlook for Lithium demand growth looks very strong indeed.